Citi (Down)Trends - shaky management, a low moat, and external issues

Ticker: $CTRN

This is not investment advice.

Recently, a US retail clothing chain concentrated in the South - Citi Trends ($CTRN) - came up on my scanner, prompting me to do a bit of digging. As a cyclical company, I figured cash flow, sales, retained earnings, and net income would be down & inventory would be up (lack of sales) in a challenging macro environment - all of which were true from Q2 '23 to Q3 '23.

Initially, I thought a significant increase in deferred income tax - a growth sign - might've been a minor sign that the company expects its tax base to increase. However, after a closer look, there seem to be more structural issues and exogenous circumstances at play.

Why?

Stock buybacks from the board were down from 10,000 in Q2 to absolutely none in Q3. A board member, Jonathan Duskin, sold 12000 shares valued at ~$286K on November 30th. The company experienced cyber attacks on Jan '23, resulting in a class action lawsuit that has yet to be resolved. In general, the company seems to be facing internal management issues, poor operational efficiency, and a mountain of legal recourse. With this in mind, there are a few questions and considerations for the future.

Why the outlook isn't bright:

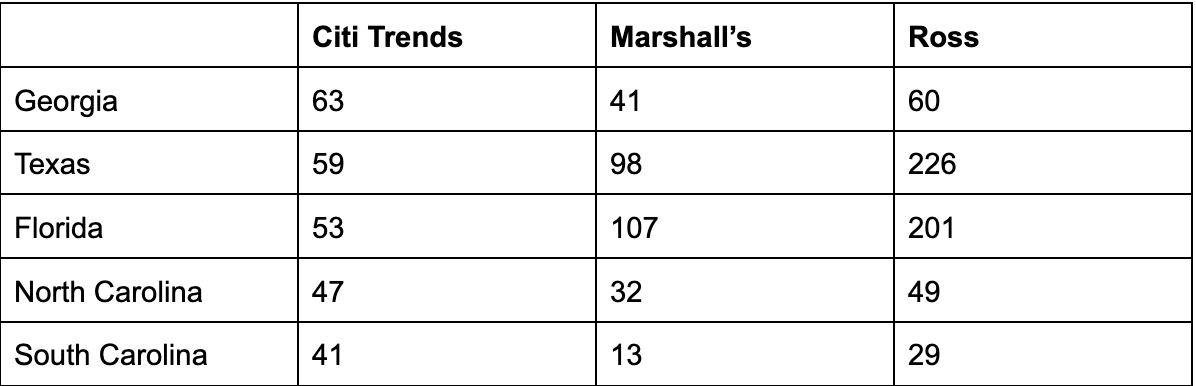

Despite an easing of macroeconomic conditions, there seems to be a general lack of internal confidence in the company. It would make sense to think that an easing of interest rates might stimulate bottom and top-line growth, but it is highly unlikely that we will see the sub-2% rates of post-2010 with inflation reaching the target rate and macro data looking positive. Value-priced brick-and-mortar retail chains are a dying breed - companies like Marshall's, Ross, TJMaxx, and Walmart dominate the in-store landscape while Amazon has overtaken a significant share in the e-commerce area. What do Marshall's and Ross have that Citi Trends doesn't - an e-commerce presence and monster market presence, respectively.

The thing is, the low moat, lack of durability, and poor competitive advantage do not pose a bright future for the company. It is also important to note that in a business highly dependent on commercial real estate, managing leases, stores, and having the ability to expand or cut down efficiently is essential; however, as COVID and the ensuing interest rate volatility showed us, this task has been made more difficult than it already is. Additionally, as aforementioned, Citi Trends lacks both an e-commerce presence and market dominance bar one state: South Carolina.

There is another recent piece of news to consider. Citi Trends recently adopted a limited-duration stockholder rights plan, making it difficult for activist funds or corporate raiders to get board control. In general, this would bode well for a well-managed and well-run business, but with internal management issues, the lack of external accountability and pressure may make it difficult for shareholders to gain more clarity about a business that, even at face value, does not look too great.

Some positives (?):

I don’t want to be a complete naysayer. Citi Trends can turn around its business, but only with a massive restructuring. They need to cut stores in states like Texas and Florida where building a competitive advantage would be an incredibly difficult task, focus on a few target areas, and optimize their margins from the bottom line. Another business plan they should consider is building an e-commerce presence. The thing is, major players like Ross can afford to have no e-presence as they have access to a diverse and deep supply chain, allowing them to quickly stock their stores with the latest inventory and funnel out older inventory at competitive prices. Citi Trends should focus on improving its relationships with its top suppliers and establishing regular supply schedules to better its in-store turnover and facilitate the creation of an e-commerce presence. However, it remains to be seen how easy it will be to cut down its stores and recenter its focus on select areas. Another hurdle is management - there seems to be something brewing internally, and the poison pill will make accountability hard.

Personal portfolio:

I shorted CTRN 0.00%↑ at 24.19 on December 4th, it is now 23.77. To hedge my position, I buy out-of-the-money (OTM) call options.

References:

- https://ir.cititrends.com/static-files/0bed2bab-f9d5-41e6-96b4-93c79ecb3df8

- https://ir.cititrends.com/static-files/51ac2a7c-5cd7-4b0f-93a8-ad337dc93802

- https://ir.cititrends.com/static-files/ae2cda09-ccb7-4228-beb5-7a28cadb1ef4

- https://www.classaction.org/news/citi-trends-facing-class-action-over-january-2023-data-breach

- https://ir.cititrends.com/news-releases/news-release-details/citi-trends-adopts-limited-duration-stockholder-rights-plan