I am by no means an expert or seasoned trader. I do not have an extensive track record; these are just my views.

Introduction

Everything flows through the US - does it really though? Global equities have outperformed the S&P 500 YTD, China is in a zero-inflation, pro-fiscal expansion environment, and EU member countries have ramped up defense spending and implemented record fiscal stimulus bills.

This is not to say that the US is unimportant, but to point to why I love global macro - you’re presented with a myriad of data, asset classes, geographies, and risks and it’s up to you to piece the puzzle together and build your own narrative. Opportunities present themselves - then disappear - so it is up to you to stay nimble, updated, and ready to pounce at any stage of the cycle.

Through a lot of research, analysis, and failure, I have attempted to build a framework for understanding the flows of money, credit, ideas, information, and more. In this post, I hope to clearly outline my framework, my trades, and share something valuable.

My process is effectively top-down . I start by reading high-level news, macroeconomic data, and consensus views, and then proceed to delve deeper into patterns and themes I believe to be interesting.

I like to start with a core view and then overlay that with other themes. The end goal is to ensure my portfolio is exposed to all possible outcomes so that I am not left out to dry if something goes wrong (which has happened and will continue to happen). Once I formulate my views, I look for asset classes to express those views in - bonds, currencies, equities, volatility, commodities, etc. - and how best to structure the trade. I then put these themes in a matrix and look for assets that offer cross-theme exposure, e.g. can I get exposure to stagflation playing out as well as a recession/policy trap?

When it comes to finally taking the trade live, I primarily use options as they offer a fixed downside and potential asymmetric upside if the trade goes well. Realistically, I will lose money on most of my positions so my portfolio return will only be driven by a few winners.

Core View - Stagflation

As expected, a Trump victory was followed by substantial volatility and uncertainty. The fact of the matter is, Trump is inflationary, pro-fiscal expansion, pro-geopolitical volatility, and anti-Fed - This situation is ideal as it offers many compelling opportunity sets.

Tariffs are the name of the game. We all know Trump came out of the gates all guns blazing, but what implications does this have on the markets? February’s cool CPI print after a hot Q4 ‘24 is likely a two-minute dip in the pool to cool off on a hot summer day. The uncertainty around inflation is a very tangible concern - a concern I wholeheartedly share.

I believe inflation is sticky, not transitory. Despite a drop in the 1-Year Expected Inflation and a cool CPI print, the transition from monetary to fiscal dominance will have definite implications. Deficit spending is up YoY, and the increase in domestic input costs from tariffs, elevated commodity prices, and sticky wage inflation do not bode well for future prints.

Unemployment is another component of stagflation. The labor force participation remains depressed, nonfarm payrolls remain down on the year, initial claims remain mixed, and the unemployment rate slightly elevated.

Finally, we get to economic growth. Nominal GDP grew 5.85% YoY in Q4 ‘23 but fell to 5.00% in Q4 ‘24. For the same time period, real GDP grew 3.2% and 2.5% respectively. As the nominal GDP growth decelerated faster than real GDP growth, this seems like a disinflationary signal. This also solidifies the importance of understanding 2nd derivative changes - the rate of change is arguably more important than change itself.

However, let’s take a look at the GDP deflator - nominal GDP minus real GDP. For Q4 ‘24, we get a value of around 2.55%. If we take a look at the December 2024 CPI print (that is, reported in January), it came in at around 3%. This implies consumer inflation is likely still sticky, which is only compounded by tariff substitute effects.

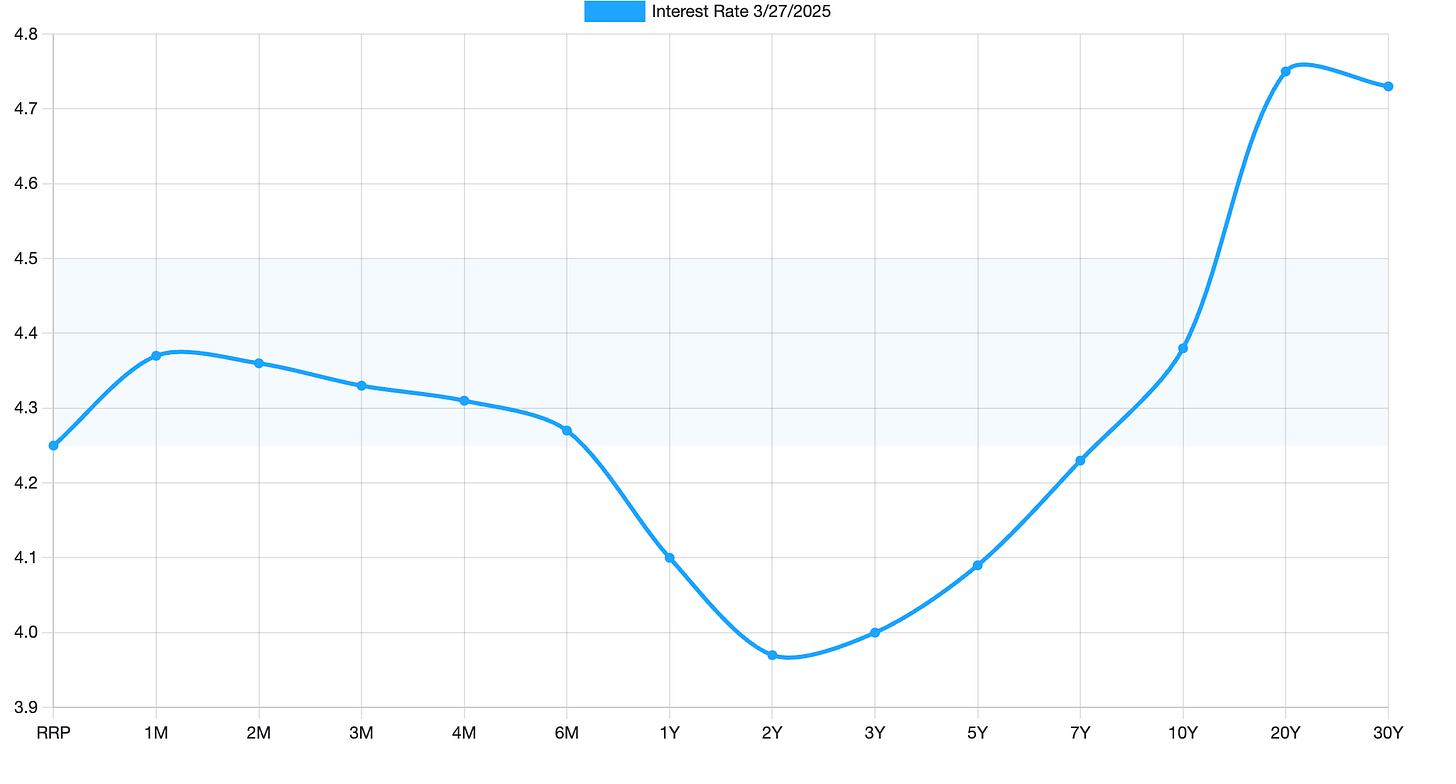

Now we get to the Fed, and eventually, trades. The Fed has firmly stuck to its hawkish stance despite the Trump administration’s pressure for rate cuts, indicating that a pause is likely at the next FOMC. Higher for longer remains bullish on yields, both nominal and real. Curve pricing demonstrates this below:

Elevated front-end yields indicate sticky inflation, while the long-end indicates long-term fiscal policy uncertainty, a rich term premium (extra return investors demand for holding a long-duration bond), and long-term inflation. However, the middle of the curve is likely pricing in a soft path of disinflation for the coming year and subdued growth, indicating these premiums are not currently embedded into the yield.

Trades:

To trade this view, I decided to purchase TLT 0.00%↑ May 16 puts at a strike of $87. As yields and bond prices have an inverse relationship, I can get exposure to elevated long-duration bond yields - 20 Yr+ - with this position. To complement TLT in the stagflation basket, I added GLD 0.00%↑ calls at a strike of $285, same expiry. If inflation remains sticky and real yields compressed, real assets like gold offer great return. Additionally, if equity volatility spikes and markets go risk-off, gold acts as a safe haven asset.

Theme 1: Recession/Policy Trap

As I stated in the introduction, it is vital that the book is primed for any turn - north, south, east, and west. There is a chance that unemployment and claims spike, CPI enter the depths of the Arctic, and we see two consecutive quarters of negative growth. This likely isn’t a theme that will play out in Q2, but who knows? Market pricing is key and if it takes a turn for the worst, it is important to be hedged. Even if a recession does not occur, there is also the off chance the Fed pivots suddenly and slashes rates, forcing bonds and equities to sell-off.

We do have some exposure to both events in our Core View with our TLT and GLD position; however, some asset classes react more violently than others. In a policy trap/recession scenario, credit spreads would drastically widen and equity volatility would spike. Let’s play it out for both scenarios:

If a recession occurs:

Credit risk heightens and bond issuers are forced to compensate bondholders by offering a higher yield

Equities sell-off with poor earnings and growth expectations

If a policy trap occurs (Fed cuts too soon):

Inflation expectations increase

Rate volatility increases, thus sending bond prices and widening spreads

Equities may sell-off (perhaps not as hard as a recession) if inflation is expected to erode growth and depress multiples

To implement this view, I purchased $77 puts on HYG 0.00%↑ expiring on May 16th and $20 VIX calls, same expiry. This trade ties back into my previous point - you’d want the most convex exposure in such events. HYG is a high-yield bond ETF, and in adverse/uncertain economic scenarios, junk bonds sell off first as the market drastically pivots to a risk-off environment. VIX is the market's ‘fear gauge’ that tracks the 1-month implied volatility of S&P 500 index options. When markets fall off a cliff, VIX shoots up. With VIX calls, we get a highly asymmetric hedge for a relatively low cost.

Theme 2: Soft Landing

What if all goes well - inflation cools, GDP growth picks back up again, and everyone has a job. Although I do not believe this is on the horizon in the next few months, having an overlay here would help.

In such a situation, I’d want a cheap, highly convex position that is not sensitive to interest rates, i.e. not bonds. HYG is a decent play for a risk-on environment, but there are too many variables to consider in the interim.

With this in mind, I decided to purchase May 16 IWM 0.00%↑ calls at a strike of $215. Small-caps generally have more beta than the market, i.e. if the S&P 500 moves up, it moves up even more, vice versa.

If there were to be a sudden positive macroeconomic pivot, high beta plays like this would do well, getting some nice equity upside on the cheap.

Theme 3: World Ex-US

It wouldn’t be global macro without some non-US flags in my brokerage account. Trump’s deglobalization stance precipitated a global risk-on/US risk-off narrative that was further propounded by Europe and China’s fiscal expansion. The tangential - arguably moreso now - threat of Russia forced EU members into breaking debt/GDP limits, passing record fiscal stimulus bills, and taking defense spending into overdrive. China’s low inflation, high fiscal transfers, record equity issuance, and 2023-24 QE have laid down a solid groundwork for a persistent equity rally after recession fears arising from a depressed property market.

To get exposure to the stagflation theme, I wanted to get exposure to a commodity driven emerging market with a relatively secular currency - Brazil proved to be the best bet here with an oil, iron-ore, and agricultural export-driven economy.

To trade this view, I purchased (all May 16 expiry) EEM 0.00%↑ $46 calls and EWZ 0.00%↑ $28 calls. EEM is an emerging markets ETF with exposure to China, India, Taiwan, etc., offering diversification in case a sole long China position does not do well. EWZ is composed of a basket of Brazilian equities which would do well if commodity prices are driven up (and stay up).

Although the theme here is implicilty betting on a US risk-off environment, there is always a risk that the US stabilizes, likely driving more outflows from global equities than initial inflows. This is why I allocated capital to a long dollar position via UUP, thus providing my global equity positions with a hedge in case investors do one (or both) things: 1. seek the higher yield from US bonds and the dollar, as US rates are currently elevated relative to global currencies or 2. seek to buy US equities on the cheap and get access to richer forward multiples.

At this point, I believe there could be a flip of the US risk-off narrative. I was recently stopped out of my calls on FEZ 0.00%↑ , the EUROSTOXX 50 ETF. The ECB is cutting at a faster rate than the Fed, and despite a strong macro environment for equities, investors may seek the higher yield of risk-free US bonds than a traditionally low valuation equity market.

Conclusion

Even with all of the themes and hedges in play, price is key. I generally deploy less than 10% of portfolio capital at any given time given the volatility and asymmetric upside options provide. I keep stops on at all times to ensure I don’t get killed by an adverse move, and if I have a winner, I may either shave some of the position for profit or implement a trailing stop to lock in a profit if the trend falls.

In all, there’s a few things I’ve learned and discussed here that I hope can be useful for your own research and trading:

Respect price. Cut your losers and size into your winners.

Be positioned for any stage of the cycle.

Put on cross-asset and cross-theme positions to get exposure to various drivers of return.

Get a read on the data pre-, during, and post-market hours - this way, you can adapt quickly to a change in your hypothesis.

Check your correlations - I have a system I run everyday that tracks the rolling correlations of my positions. This way I can divvy up my risk better and reallocate capital if needed.